Legal Battles Ahead: Challenges Loom Over Trump’s New 10% Global Tariff

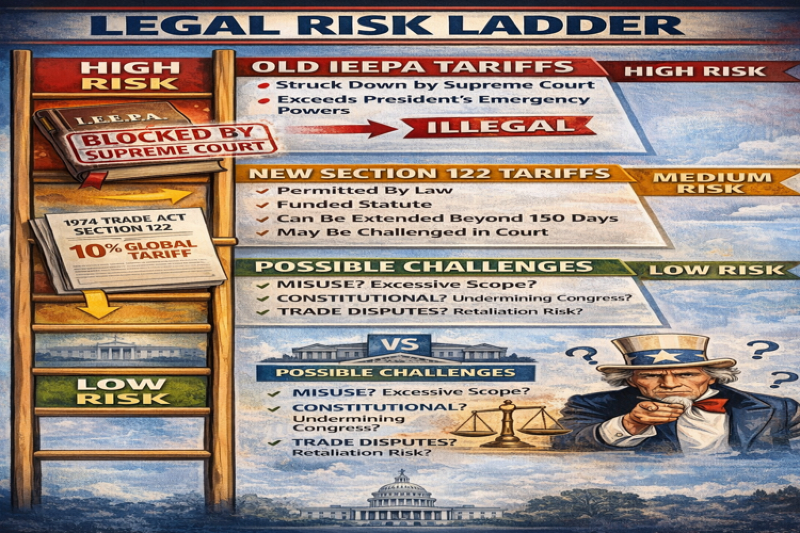

While President Donald Trump swiftly rolled out a new 10% global import tariff following the Supreme Court’s rejection of his “Liberation Day” tariffs, legal experts warn that the move is far from immune to challenges.

Businesses, trade groups, and foreign governments may contest the tariff on grounds of scope, duration, or procedural compliance, while the question of refunds for the previous $130 billion in IEEPA tariffs remains unresolved.

The new levy introduces a legally valid framework—but with potential years of litigation and administrative disputes ahead.

Old Tariffs (Liberation Day / IEEPA Tariffs)

Authority: International Emergency Economic Powers Act (IEEPA) – a law meant for national emergencies.

Scope: Broad, sweeping tariffs on imports from all countries.

Rate: Varied, but included high duties impacting billions in imports.

Problem: Supreme Court ruled Trump exceeded his authority. IEEPA could not be used for permanent, sweeping tariffs.

Business Impact: Many firms already paid tariffs (~$130bn) and now face uncertainty over refunds. Small businesses suffered unpredictable costs; profits and pricing were hit.

New Tariffs (Trump’s 10% Global Tariff)

Authority: Section 122 of the 1974 Trade Act (plus possible use of Section 301).

Scope: Global imports; effectively replacing the IEEPA tariffs.

Rate: 10% (up to 15% legally allowed under Section 122).

Duration: Can be imposed for 150 days before Congress must approve or intervene.

Business Impact: Tariffs remain, but with more predictable legal framework. Businesses have notice periods; some planning and compliance time is available. Refunds for old tariffs are still uncertain and may take years in litigation.

Key Implications

Legal and Constitutional:

Supreme Court reaffirmed that Congress controls taxing authority; presidents cannot use emergency powers to impose sweeping import taxes.

Trump is now using alternative statutes to maintain tariffs while staying within constitutional limits.

Business / Economic:

Old tariffs caused profit losses, price hikes, and uncertainty for importers.

New tariffs allow more predictable planning, but costs still fall on consumers and businesses.

Refunds for IEEPA tariffs remain unresolved; small firms may struggle to recover money.

Political:

Court ruling exposes divisions within the Republican Party and challenges Trump’s economic nationalism.

Trump’s aggressive response signals that tariffs remain a central policy tool, despite legal checks.

Global Trade:

Exporters and supply chains worldwide may face continued uncertainty, though courts now act as a check on unilateral tariff expansion.

Temporary stabilization may occur, as unpredictable “emergency” tariffs are no longer valid, but new 10% tariffs continue to affect global trade flows.

In short:

Old: Sweeping, legally questionable tariffs causing chaos and legal battles.

New: 10% global tariff under a valid law, temporarily stabilizing legality but leaving financial uncertainty and potential long-term litigation.

Implication: Executive power in trade is now more constrained, but Trump still wields significant influence. Businesses and global markets face continuing disruption, just in a legally different form.

the new 10% global tariff can absolutely be challenged, though the legal dynamics are different from the old IEEPA tariffs. Here’s a detailed breakdown:Why the New Tariff Could Face Challenges

Statutory Interpretation Disputes

Trump is using Section 122 of the 1974 Trade Act and potentially Section 301.

While these laws explicitly allow the president to impose tariffs, businesses or trade groups could argue misuse or overreach—for example, that the tariff exceeds the intended scope, or the process wasn’t properly followed.

Duration and Scope

Section 122 allows tariffs up to 15% for 150 days.

Critics could argue that the administration is applying it beyond intended limits, especially if it’s extended repeatedly without Congressional approval.

Constitutional Challenges

The Supreme Court struck down the old tariffs because the president cannot unilaterally levy broad import taxes under emergency powers.

While Section 122 is a valid statute, opponents could still argue that broad global tariffs on all imports are effectively taxation, which may need more Congressional oversight.

International Trade Law

Foreign governments or businesses might challenge the new tariffs under WTO rules or bilateral trade agreements, claiming the tariffs are unjustified or retaliatory.

This could trigger trade disputes or retaliation, even if the tariffs are technically legal in US law.

Refund & Administrative Litigation

Even if the tariff itself is legal, implementation details (who pays, exemptions, notice period) could be challenged in courts.

Importers could sue for incorrect application, overcharges, or procedural errors.

Why Challenges Might Fail

Section 122 and Section 301 are explicit statutory authorities, unlike IEEPA which was interpreted as too broad.

Courts generally defer to Congress-granted presidential powers in trade, so as long as the administration follows the rules (investigations, notice, duration), a challenge is harder to win.

Any challenge would likely delay the tariff rather than immediately overturn it, especially since Trump’s team could argue it’s within legal limits.

In short:

Yes, the new tariffs can be challenged, but it would be a narrower legal fight, focusing on process, scope, and duration, rather than outright authority.

The biggest ongoing risk is refunds and administrative disputes, which could drag on for years and affect businesses.

➡️ Read more:

https://thereporter24.com/news/retroactivity-debate-can-trump-s-new-10-tariff-apply-to-the-past

https://thereporter24.com/news/trump-moves-to-bypass-supreme-court-ruling-with-fresh-10-global-tariff

https://thereporter24.com/news/us-supreme-court-blocks-trump-s-liberation-day-tariffs-a-constitutional-rebuke-with-global-ripples