Global Cooperation Faces a New Economic Reality: Insights from Davos 2026

February 8, 2026: The 56th Annual Meeting of the World Economic Forum (WEF) has underscored the shifting landscape of global economic cooperation, revealing both challenges and opportunities as multilateralism faces unprecedented strain.

Against a backdrop of geopolitical friction, accelerating technological change, and economic uncertainty, world leaders, corporate executives, and civil society representatives gathered in Davos to explore how nations and businesses can navigate an increasingly contested global system.

This year’s gathering saw over 60 heads of state and government join hundreds of business leaders to discuss the future of global trade, investment, and innovation. Central to the conversation was a recognition that while traditional multilateral frameworks are under pressure, new forms of cooperation—often smaller, flexible, and purpose-driven—are emerging to fill the gap.

Economic Fragmentation and Risk

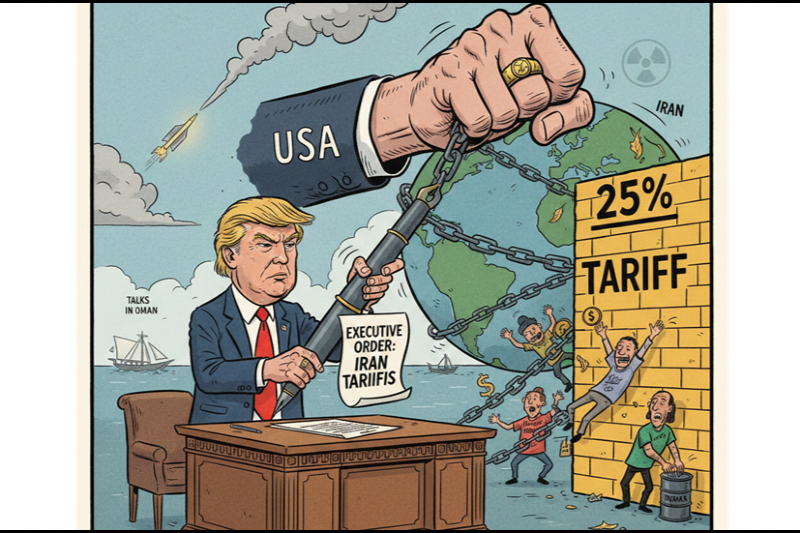

Global trade and finance remain deeply interconnected, yet geopolitical tensions have introduced new vulnerabilities. Tariffs, export controls, sanctions, and other forms of economic statecraft are increasingly common, reshaping how nations and companies operate.

Leaders like France’s Emmanuel Macron and Canada’s Mark Carney emphasized the growing importance of “strategic autonomy” in trade, technology, and energy as a safeguard against systemic shocks.

“Geoeconomic confrontation is now the top global risk for 2026,” Carney noted, describing the current era as a “rupture” rather than a smooth transition from the old order.

The focus is increasingly on resilience over efficiency—a shift that has profound implications for global supply chains, investment flows, and the cost of doing business internationally.

Multilateralism Adapts

While confidence in global institutions has waned, Davos 2026 highlighted that cooperation has not disappeared—it has evolved.

Leaders discussed frameworks such as “minilateralism” and “value-based realism,” which prioritize small, issue-focused coalitions over broad, universal agreements.

Bilateral and regional trade agreements have surged, increasing by over 50% compared to the past decade, and initiatives like the Minerals Security Partnership demonstrate how nations are coordinating critical supply chains even as traditional global forums falter.

World Trade Organization Director-General Ngozi Okonjo-Iweala emphasized the resilience of trade networks despite geopolitical uncertainty: “Trade continues largely because nations find ways to cooperate pragmatically, even outside traditional multilateral structures.”

Technology and Economic Opportunity

Davos 2026 also stressed that innovation cannot flourish in isolation. Frontier technologies—from artificial intelligence to quantum computing—require cross-border coordination, access to global data, and cooperative regulatory frameworks.

European Central Bank President Christine Lagarde highlighted the economic cost of fragmentation, noting that AI’s full productivity potential depends on standards, licensing, and data-sharing agreements that transcend national borders.

Investors and companies alike must navigate this new landscape. From “digital embassies” that host sensitive data abroad while preserving sovereignty, to friend-shoring supply chains for semiconductors and critical minerals, the message is clear: economic strategy now requires geopolitical literacy.

Business Implications

For multinational corporations and investors, these trends imply both risk and opportunity:

Risk: Political fragmentation and geopolitical tensions increase operational costs, disrupt supply chains, and create uncertainty for long-term planning.

Opportunity: Agile, specialized coalitions and sector-specific agreements can enable faster investment, innovation, and market entry. Strategic resilience is now a competitive advantage.

Companies that adapt by diversifying supply chains, investing in secure and sustainable infrastructure, and engaging in cross-border collaborations will be better positioned to capture growth in emerging markets. Likewise, investors looking beyond traditional assets can benefit from sectors such as green energy, AI, and critical minerals, which are increasingly shaped by multilateral partnerships rather than singular national policies.

Looking Ahead

Davos 2026 did not present a single blueprint for global cooperation. Instead, it revealed a world in flux, where traditional frameworks are giving way to flexible, interest-based coalitions.

Leaders and businesses must operate in this space of calculated uncertainty, balancing national priorities, corporate goals, and collective responsibility.

The takeaway for economies worldwide is clear: cooperation is no longer guaranteed, but it remains essential. Those who can navigate the new order—combining resilience, innovation, and strategic partnerships—will shape the next era of global economic growth.

Key Takeaways for Readers & Investors:

Multilateralism is adapting, not disappearing; look for agile coalitions in trade and technology.

Geopolitical risks are reshaping costs, supply chains, and investment decisions.

Innovation is global; countries and firms must collaborate to unlock AI, biotech, and energy potential.

Strategic resilience—rather than efficiency alone—defines competitive advantage in 2026.