*Health sector to get Tk 41,908cr

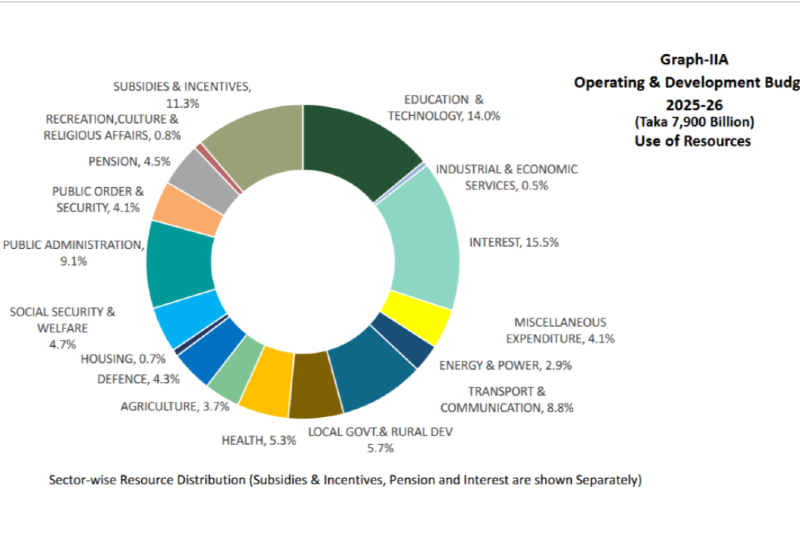

In a marked departure from previous growth-driven and infrastructure-heavy budgets, Bangladesh’s interim government has unveiled a conservative Tk7.90 lakh crore national budget for the fiscal year 2025–26.

The budget reflects a strategic shift toward stabilizing the macroeconomy, containing inflation, and ensuring social equity, Finance Adviser Dr Salehuddin Ahmed announced during the budget presentation on Monday.

The budget is 0.9% lower than the outgoing fiscal year’s outlay of Tk7.97 lakh crore, signaling a turn toward fiscal discipline, cautious expenditure, and long-term resilience over aggressive expansion.

“Our goal is to build an inclusive, non-discriminatory system that enhances the quality of life for all citizens,” Dr Ahmed said, emphasizing that the focus this year is not on rapid growth, but on reinforcing the foundation of the economy.

Key Economic Targets and Fiscal Framework

- GDP growth target set at 5.5%, slightly above the revised 5.25% for FY25, although institutions like the World Bank, IMF, and ADB forecast lower growth under 5%.

- Revenue target: Tk5.64 lakh crore, with Tk4.99 lakh crore expected from NBR sources.

- Budget deficit trimmed to Tk2.26 lakh crore (3.6% of GDP), down from Tk2.56 lakh crore in the current year.

- Tk1.25 lakh crore to be financed domestically (mostly through bank borrowing), and Tk1.01 lakh crore from foreign sources.

Expanded Social Safety Net to Alleviate Hardship

The government has significantly expanded key social protection programmes to shield vulnerable communities from the rising cost of living. Both the number of beneficiaries and monthly allowances will increase from July:

- Old-age allowance: Raised from Tk600 to Tk650

- Allowance for widowed, deserted, and destitute women: Tk550 to Tk650

- Disability benefit: Tk850 to Tk900

- Mother and Child Benefit: Tk800 to Tk850

- New monthly stipend of Tk650 for underprivileged groups

These adjustments are aimed at reducing poverty, strengthening household income, and promoting inclusive welfare across the country.

Support for Education and Teachers

In a long-anticipated decision, the festival bonus for MPO-enlisted teachers will increase from 20% to 50% of their basic salary. This move acknowledges their role in the education system, especially amid growing inflationary pressures.

Agricultural Support and Food Security

To bolster food production and help farmers amid global price volatility, the government has allocated Tk17,000 crore in agricultural subsidies. This includes support for fertilisers and incentives under existing rehabilitation and incentive programmes. These steps are aimed at ensuring food security, stabilizing crop yields, and cushioning rural livelihoods.

Incentives for Small Savers and Entrepreneurs

The excise duty exemption limit on bank deposits has been raised to Tk3 lakh from Tk1 lakh. The existing Tk150 duty on lower balances had disproportionately affected low-income savers, and the new threshold is designed to encourage bank savings while easing the financial burden on the poor.

To promote youth-led innovation, the budget introduces a Tk100 crore startup fund dedicated to the ICT sector. Alongside this, 491 ICT training centres at the Upazila level are being developed to equip youth with digital skills and foster entrepreneurship.

Strengthening the Health Sector

The health and family welfare sector will receive Tk41,908 crore in FY26—an increase of Tk501 crore from the previous year. The allocation aims to improve healthcare infrastructure, expand access to services, and ensure emergency preparedness in light of recent global health challenges.

Energy Sector Relief and Reforms

In a move to relieve consumer pressure and keep inflation in check, the government has put a hold on electricity tariff hikes. Instead, it plans to reduce power production costs by 10%, thus minimizing subsidy requirements.

To lower energy expenses, the government will also withdraw the 15% VAT on imported LNG, benefiting gas distribution companies and consumers alike.

Additionally, domestic energy production is being ramped up, with a target of 648 million cubic feet of gas to be sourced locally within this year, and 1,500 million cubic feet by 2028.

Digital Economy Incentives

To enhance digital affordability, the budget reduces the source tax on internet services from 10% to 5%. The turnover tax on mobile operators has also been cut to 1.5% from 2%. These reductions are expected to support wider digital inclusion and stimulate the digital services market.

Infrastructure Development via PPP

While overall development expenditure under the Annual Development Programme (ADP) has been trimmed to Tk2.30 lakh crore, the budget provides Tk5,040 crore to boost Public-Private Partnership (PPP) initiatives. These funds will be overseen by the Bangladesh Economic Zones Authority (BEZA) and include provisions for managing Private EPZs.

Most long-term and non-priority projects have been deferred or excluded, with only the Matarbari development project continuing as a major infrastructure initiative.

DC Graduation and Trade Expansion Strategy

As Bangladesh prepares for its LDC graduation in November 2026, the government has introduced a Smooth Transition Strategy (STS) to safeguard competitiveness and economic stability. Key elements include:

- Expansion of the logistics sector

- Trade agreement negotiations with China, Japan, Singapore, Sri Lanka, Malaysia, and South Korea

- Support for export-oriented industries like pharmaceuticals and leather

- Operationalizing the API Park in Munshiganj

- Developing a solid waste treatment plant at the Savar Tannery Complex

Bangladesh’s pharmaceutical industry, already exporting to over 150 countries, is expected to gain further strength through these initiatives.

Conclusion

The FY2025–26 budget reflects a pragmatic and pro-people approach, aiming to stabilize the economy while addressing pressing social needs. With an emphasis on austerity, targeted subsidies, and inclusive development, the interim government has presented a blueprint for a resilient, forward-looking Bangladesh.

“This budget is not about speeding up growth at any cost—it’s about building a strong, inclusive, and sustainable economic foundation,” Dr Salehuddin Ahmed stated.